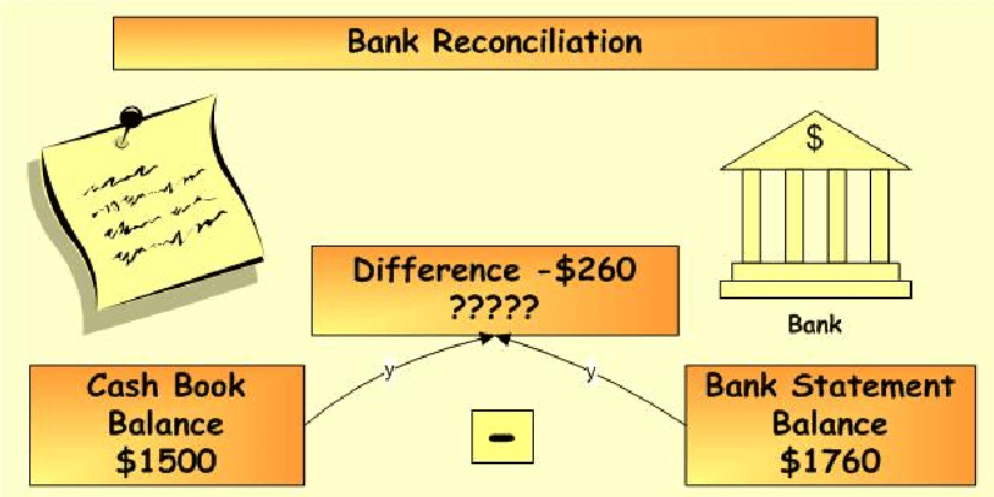

Account Reconciliation

Account Reconciliation provides clients with accurate financial records, fraud detection, financial control, informed decision-making, and regulatory compliance. It is a critical process to maintain financial integrity and ensure the client’s financial well-being.

Financial Reporting

Financial Reporting serves as a critical tool for understanding, analyzing, and assessing the financial aspects of a business due to its transparency, performance evaluation capabilities, comparability, and historical recordkeeping benefits. LAO strives to give their clients knowledge, wisdom, and experience to succeed and meet their financial objectives.

Bookkeeping Services

Bookkeeping Services are crucial for clients as they ensure accurate financial records, compliance with tax obligations, financial analysis and reporting, cost management, cash flow management, and the ability to focus on core business activities. By leveraging bookkeeping services, clients can streamline their financial processes and maintain a strong financial foundation for their business.

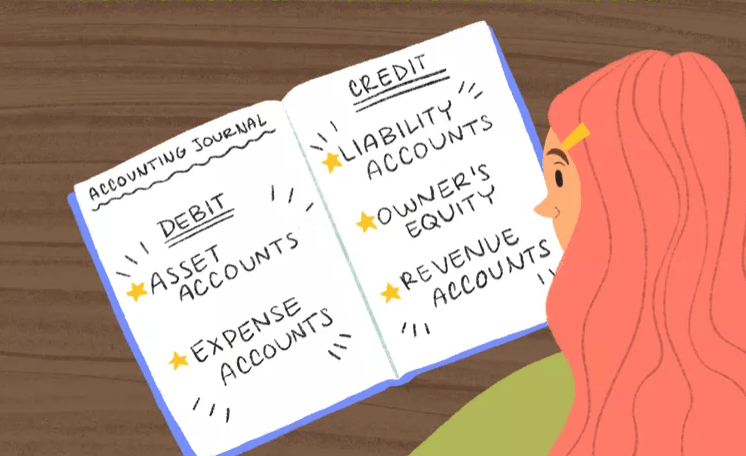

General Ledger Oversight & Journal Entries

General Ledger Oversight & Journal Entries serves as the central repository for all financial transactions and records. It’s the primary method of recording financial transactions capturing the dual-entry bookkeeping principle.

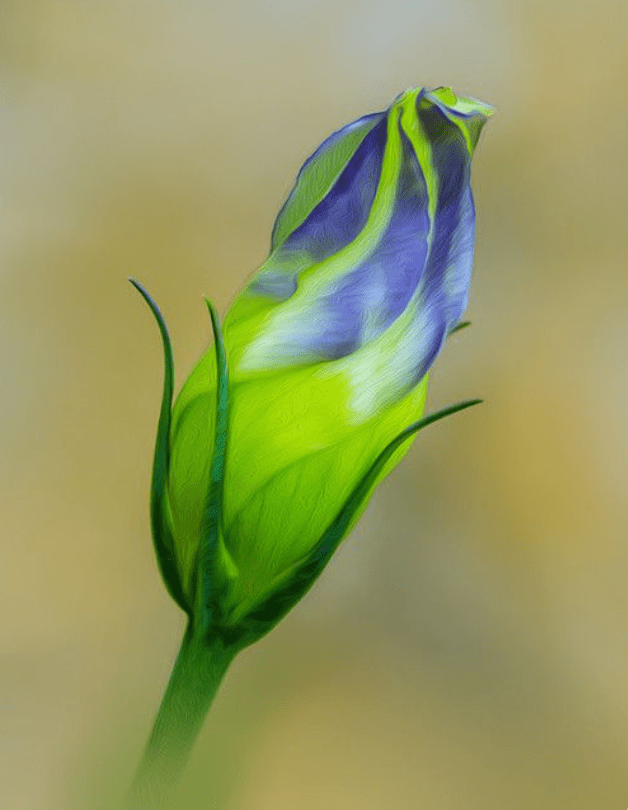

Nurturing Growth & Maximizing Potential

Accounts Payable & Accounts Receivable

Accounts Payable & Accounts Receivable are important components of the overall financial management of a business. Proper management of these accounts is essential to maintain good relationships with suppliers and customers, ensure accurate financial reporting, and optimize cash flow.

Nurturing Growth & Maximizing Potential are approaches used to helping clients. Just as a gardener would observe a budding flower, LAO understands the importance of financial health in supporting growth and expansion. It’s important to prune and weed to maintain areas where clients need refinement, analyze the financial data and pinpoint inefficiencies. Futhermore, LAO recognizes the importance of nurturing relationships; understanding that success in business is not solely determined by numbers on a balance sheet but also by the collaborative efforts of individuals and organizations working together.

Sales & Use Tax Filings

Sales & Use Tax Filings is a legal requirement that helps you stay in compliance, maintain a good business reputation, and support the functioning of government services. It’s essential to understand and fulfill your tax obligations to avoid penalties and protect your business.

1099 Processing

1099 Processing is an annual filing typically issued to independent contractors, freelancers, and self-employed individuals by the businesses or clients they have provided services to. It is important to note that the responsibility of issuing a 1099 form lies with the businesses or clients who have paid $600 or more to an individual or entity for services rendered during the tax year. The recipient of the 1099 form is required to report the income stated on the form when filing their tax return. LAO can assist you in staying on top of receiving W-9 forms throughout the year, ensuring that you are well-prepared to file on time.

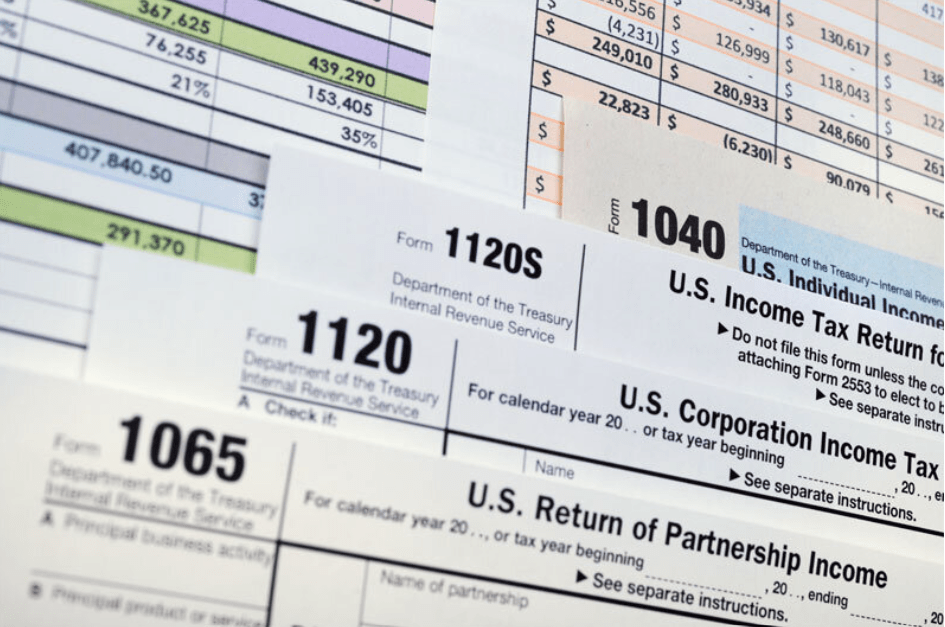

Tax Returns

Tax Returns provide a comprehensive summary of your financial activities for the year and accurately depict your true profit. LAO strive tirelessly to ensure that you receive the best possible tax return, and dedicated to working diligently to maximize your eligible deductions and credits, ultimately aiming to optimize your tax refund or minimize your tax liability.