LAO Accounting Services – Basic Accounting/Bookkeeping Services Price List

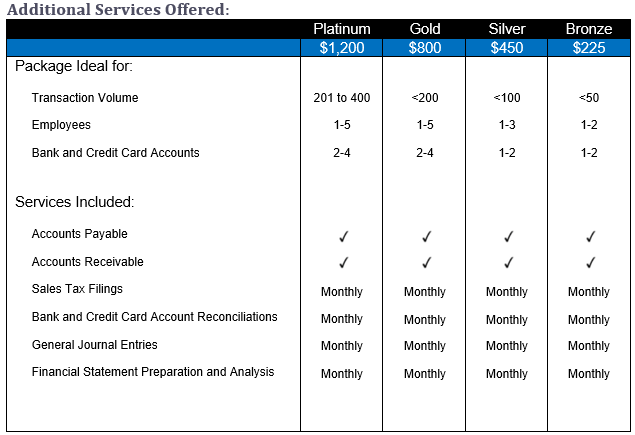

Service fees operate on a fixed monthly fee and are prepaid monthly or quarterly. Monthly fees for basic accounting services are determined by transaction volume as per the table below. Each package can be tailored to fit your business needs; this is just a basic template for most general businesses.

Transaction Volume: Any transaction volume over 400 will need a customized quote.

Catch-up Services: Enter all transactions for the year to get your books caught up. Limited availability during tax season, so please call during off peak, if possible, for a customized quote.

QuickBooks Set-up: Fixed cost depending on type of business and structure, includes setting up chart of accounts, editing QuickBooks preferences to match company needs, creation of customized invoice template using company logo, setting up vendors, clients and employees, and more. Please call for a customized quote.

Payroll: Initial payroll set-up is $350. Payroll services thereafter are $175/monthly for up to 5 employees, and $120/monthly for up to 2 employees. Prepare & File EDD quarterly reports Forms DE-9 and DE-9C. Prepare & File IRS quarterly reports Forms 940 & 941.

QuickBooks Training: Cost to be billed hourly and not more than five employees to be trained at a time is $85/Hourly.

QuickBooks Tune-up: Review your transactions for the year; clean up stray entries; customize reports; balance general ledger to subsidiary record; and additional personalized training. Please call for a customized quote.

Annual Tax Filings:

W-2/W-3 form is $30.00 per employee per form. $110 base set-up fee.

Annual 1099s preparation is $95 base set-up fee plus each 1099 form will be charged separately at $25, and each 1096 form will be charged separately at $30.

Annual Payroll tax returns to IRS & EDD is $200 for both.

Individual Tax Return Preparation:

Filing extension: $200.00

1040 with state return with no itemized deductions: $310

1040 with Schedule A (itemized deductions) and state return: $495

1040 with Schedule A, Schedule C (business income) and a state return: $700

Costs can vary depending on the complexity of your income and tax situation. Each additional Federal Form will be charged separately at $85. Be organized and thorough to avoid an increased fee for disorganized or incomplete information.

Start and file early, an additional fee of $150 will be charged if the information is not provided at least two weeks before a filing deadline.

An additional fee for expediting a tax return is $300.

Unclaimed Property Reporting and Claiming: Review your records for any unclaimed property that your company may be holding and report the property to the state. Also see if the state is holding money or property that belongs to you and claim the property. Please call for a customized quote.

Notary Public Service: Licensed professional notary services that fit your schedule. $10 fee applied to each signature being notarized. [Currently not offering this service]

Pick-up & Delivery: $80 per pick-up and delivery fee for in person paraprofessional. Free if information is emailed or mailed.

Special Projects: All other special projects that do not fit within the fixed monthly fee packages are charged at $85/hourly.